How to Get Weight Loss Surgery Approved?

Are you considering going under the knife to lose weight because diet and exercise have failed you? If so, then you might be wondering how to get bariatric surgery approved. In this comprehensive article, we have put together some tips to show you how to get weight loss surgery approved by insurance.

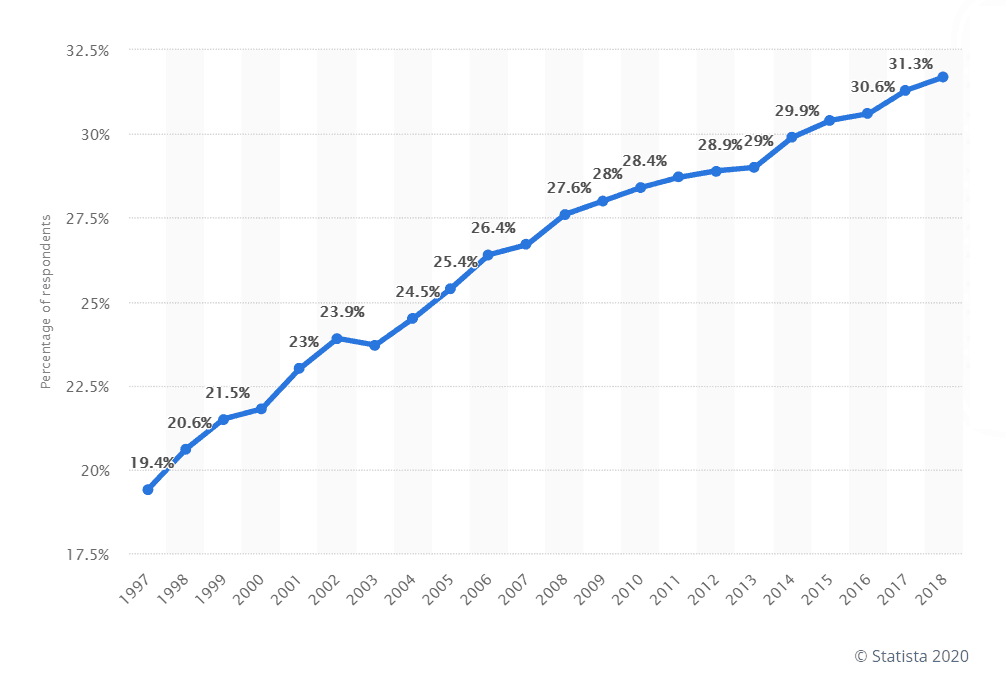

Obesity rates among adults have skyrocketed in the US. And the thing with obesity is it never comes alone – it also brings a myriad of other diseases with it such as high blood pressure, diabetes, heart stroke, and gout, to name a few.

According to the American Society for Metabolic & Bariatric Surgery (ASMBS), even though almost 22.8 million Americans are eligible for weight loss surgery, only 1% are able to receive the procedure. Prevalence of obesity among adults aged 20 and over in the U.S. from 1997 to 2018 – Source: Statista

Why? Because most insurance companies in America don’t provide coverage for bariatric surgery. And some that do cover it, pose so many requirements on the eligibility criteria that the patient fails to meet them. These surgeries can cost a fortune if they are funded entirely out of your pocket, but don’t worry, we have got you covered!

Why? Because most insurance companies in America don’t provide coverage for bariatric surgery. And some that do cover it, pose so many requirements on the eligibility criteria that the patient fails to meet them. These surgeries can cost a fortune if they are funded entirely out of your pocket, but don’t worry, we have got you covered!

Contact Jet Medical Tourism® to learn more about getting approved for weight loss surgery.

How to get approved for weight loss surgery in Mexico?

Since weight loss surgery costs around $15,000 – $30,000+ in the US, more and more patients are heading over to Mexico to receive the procedure. Statistics show that almost 1.4 million Americans crossed the border in 2018 to undergo medical treatment including some form of bariatric surgery.

If your insurance carrier is refusing to cover your bariatric procedure and you’re wondering how to get weight loss surgery approved in Mexico, here are some simple guidelines for you:

You have to meet the following criteria to be eligible for weight loss surgery in Mexico:

- You must have a body mass index (BMI) of 30-35 (if you’re obese)

- You must have BMI for gastric sleeve of 35-40+ (if you are morbidly obese)

- You must be suffering from obesity-related illnesses like diabetes, breathing issues, heart problems, hypertension, etc.

Bariatric surgery in Mexico costs around $3,599 – $5,500 for inpatient treatment. This means everything from ground transportation and hotel stay to cost of medications is included in this price tag. However, if you can’t afford to pay for the surgery all at once, our Jet Medical Tourism® team can provide you with super affordable payment plans as well.

Does insurance cover weight loss surgery?

According to the ASMBS, denial of insurance coverage is the biggest reason why people decide not to have the weight loss surgery. There have been several cases where patients were denied coverage at least 3 times before finally getting approved for the procedure.

To answer your question, “does insurance cover weight loss surgery” – it depends on case to case. Unfortunately, it is very common for the American health insurance companies to deny paying for bariatric surgery.

Whether the weight loss surgery covered by insurance or not, it varies on your insurance company and your unique situation. Some insurers do cover it, as long as it is considered “medically necessary”.

However, if you are wondering “is weight loss surgery covered by insurance” for cosmetic purposes only, it is highly unlikely the company will provide coverage. In other words, if you want the weight loss surgery to simply look thinner but you are not in any grave danger, it will not be covered.

Related: Should you get bariatric surgery in Mexico or USA? Compare risks and costs

How to get insurance to pay for bariatric surgery?

It is possible that your health insurance company (both independent and employer-sponsored) may be willing to cover at least some of the costs associated with bariatric surgery.

Here are a few steps you can take to get your weight loss surgery covered by insurance:

- Call your insurance provider directly: Contact the customer service number listed on your card and ask to speak to someone about your policy coverage. Tell them exactly which weight loss surgery you want and where you’re planning to receive it.

- Speak to your HR manager: If you have a health insurance policy through work and you’re wondering how to get weight loss surgery approved, discuss your options with an HR representative. Your employer may be willing to offer a plan that helps you cover the cost of your procedure.

- Talk to your doctor: If you’re still glossing over “how do I get approved for weight loss surgery?”, see your doctor. Ask them what forms must be provided to your insurer to qualify you for the surgery. Remember, if your doctor deems the surgery “medically necessary” for you, you have better chances of getting approved for coverage.

Even if you are not sure how to get weight loss surgery approved, you don’t have to cover the entire cost alone. Some health insurers provide partial or full coverage but if that doesn’t work out, we at Jet Medical Tourism® can help you get the healthcare you need – within your budget!

Related: Financing weight loss surgery in Mexico: Bariatric financing options

What all procedures of weight loss surgery are covered by insurance

Most insurance that covers bariatric surgery approve all major types of weight loss surgeries:

- Gastric sleeve or vertical sleeve gastrectomy

- Gastric Bypass

- Gastric Lap band

- Duodenal Switch surgery

Does insurance cover gastric sleeve?

Yes, but only if weight loss surgery is a covered benefit under your insurance plan. If you’re wondering “is gastric sleeve covered by insurance”, it’s best to talk to your insurance provider directly about this.

Does insurance cover lap band surgery?

Yes, most insurance policies that cover weight loss surgery provide partial or full coverage for gastric lap band procedure. But you should contact your insurer directly to know whether lap band is covered by insurance.

Related: Should you consider lap band to gastric sleeve conversion surgery?

Does insurance cover gastric bypass?

Yes, but only if your health insurance policy covers bariatric surgery. Some insurance providers have specific requirements to prove a medical need for gastric bypass procedure. To get a precise answer to does insurance cover bariatric surgery, call your insurance company directly.

Does insurance cover lap band removal?

It depends. If your insurance company provided your coverage for the initial gastric lap band surgery, there’s a good chance they will also cover the band removal procedure. If you want to get your lap band removed and want to convert to gastric sleeve or another procedure, you’ll need to know “will insurance pay for weight loss surgery”.

Since it also depends case to case, we recommend calling your insurance carrier directly.

Related: What is lap band removal surgery?

If you find out that you don’t have coverage, contact us at Jet Medical Tourism® about a payment plan and other financing options. No one should live with compromised health just because their insurance provider refuses to cover the treatment! Jet Medical Tourism® makes it possible for patients to receive state-of-the-art healthcare even without insurance.

Related: Lap band removal after 10 years: Everything you need to know

Insurance that covers bariatric surgery

Wondering what insurance covers weight loss surgery? Here is a complete list of all health insurance carriers in America that have policies that cover weight loss surgery.

Please note that just because you have an insurance policy from any of the below-mentioned companies, doesn’t mean your bariatric surgery will be covered. Those wondering “is weight loss surgery covered by insurance?” should know that it depends on what kind of insurance policy you bought. Some of the prominent insurance providers include:

- Aetna

- AmeriGroup

- Anthem Blue Cross and/or Blue Shield

- Cigna

- Coventry Health Care

- HealthFirst

- Humana

- Kaiser

- United Healthcare

Medicare bariatric surgery

If you have Medicare insurance, you obviously want to know does Medicare cover bariatric surgery procedures like VSG, Gastric Bypass etc.? The answer is unfortunately not very clear.

Does Medicare cover bariatric surgery?

The short answer is yes, Medicare covers weight loss surgery – but not in every case.

Medicare requirements for bariatric surgery

Their criteria are similar to other insurance companies so if you want to know how to get weight loss surgery approved by Medicare, you must meet the following Medicare requirements for bariatric surgery:

- You must have a BMI of more than 35.

- You must have at least one obesity-related health problem (hypertension, diabetes, osteoarthritis, etc.)

- You must have struggled with obesity for the last 5 years.

- You must have legitimate medical documents and health records from those last 5 years.

If you meet all these criteria, Medicare will need you to go through a lengthy process to receive their approval. This Medicare bariatric surgery approval process includes:

- Having a record of at least 1 attempt at a weight loss program under the supervision of a doctor.

- Showing proof that you failed at least 1 supervised weight loss program

- Undergoing blood tests for Pituitary, Adrenal, and Thyroid.

- Undergoing a full psychological evaluation.

United Healthcare bariatric surgery

Most insurance policies by the United Healthcare don’t cover bariatric surgery. But there are some rare plans that include it as long as it is deemed medically necessary by your primary care physician.

Also, if you live in a state where insurance companies are required to cover bariatric procedures, your United Healthcare insurance policy may provide partial or full coverage for the same.

Does United Healthcare cover bariatric surgery?

Yes, it is possible that you may qualify for United Healthcare bariatric surgery but only if you live in a state where bariatric coverage is mandatory and it is deemed a medical necessity for you.

United Healthcare bariatric surgery requirements 2020

If you want to know how to get weight loss surgery approved by United Healthcare, you have to meet the following criteria:

- You must be 18 years of age or older.

- You must have a BMI of 40 or more.

- You must have a BMI of more than 35 and at least one obesity-related issue, like severe sleep apnea, stroke, hypertension, or type-2 diabetes.

- You must show proof that you have followed weight loss diets in the past (like Weight Watchers) and failed.

Medicaid weight loss surgery coverage

We get a lot of questions asking will Medicaid pay for weight loss surgery, unfortunately, the answer varies from patient to patient.

Does Medicaid cover weight loss surgery like Gastric sleeve and gastric bypass?

Yes, it is possible to get Medicaid to cover your gastric bypass or VSG surgery, but it is not guaranteed. In order to get your weight loss surgery covered by Medicaid, you will need to prove that you have a life-threatening a result of obesity.

Medicaid requirements for bariatric surgery

To qualify for Medicaid weight loss surgery, you must meet the following criteria:

- Your BMI must be over 35.

- Your BMI must be over 40 if you are below the age of 21.

- You must have at least one obesity-related illness.

- You must have documentation showing that you tried to manage your weight in the past, but those attempts failed.

- You must have completed a 6-months long weight loss program under medical supervision (you must have attempted this program within the previous 12 months before surgery).

- You must have a printed letter from your doctor recommending the medical necessity of bariatric surgery.

- You need to pass a psychological evaluation showing you can change your lifestyle for the better after surgery.

- Your weight loss surgery must be performed at a Center for Excellence only.

Aetna bariatric surgery

Aetna doesn’t offer any individual health plan that covers weight loss surgery. This means you can only qualify for the Aetna weight loss surgery if your policy is sponsored by your employer.

The majority of insurance plans offered by Aetna exclude coverage of surgical procedures and treatments of obesity unless specifically approved by Aetna.

Does Aetna cover weight loss surgery

Aetna only covers weight loss surgery when the health insurance policy is employer-sponsored.

Aetna bariatric surgery requirements

If your employer has provided you an Aetna health insurance policy, you will need to meet the following Aetna bariatric surgery requirements in order to qualify:

- You must have a BMI of 40 or more.

- You must have a BMI of 35 and at least one of these diseases: type 2 diabetes, coronary heart disease, severe hypertension, or severe sleep apnea.

- You must show proof that you have attempted weight loss in the past and failed.

- You must show proof that you’ve participated in at least one weight loss program under medical supervision.

How much does Aetna cover for gastric sleeve?

It depends on case to case. We recommend calling Aetna directly to find out how much does Aetna cover for gastric sleeve in your case.

Cigna weight loss surgery

Cigna weight loss surgery is only possible if you have an employer-sponsored plan or a group medical plan that specifically includes bariatric surgery.

Does Cigna cover bariatric surgery?

Yes, Cigna covers bariatric surgery under employer-sponsored and group medical plans.

Cigna bariatric surgery requirements

In order to qualify for the Cigna weight loss surgery, you will need to meet the following Cigna bariatric surgery requirements 2019:

- You must be 18 years of age or older.

- You must have a BMI of more than 40 for at least the past 2 years.

- You must have a BMI of 35-39.9 for at least the past 2 years, and you must have at least one obesity-related illness.

- You must have participated in a medically-supervised weight loss program within the last 2 years.

- Your doctor must deem the bariatric surgery a medical necessity for you.

- You must have a psychological evaluation that shows you are capable of changing your lifestyle for weight loss.

Tricare weight loss surgery coverage

Tricare provides coverage for bariatric surgeries but you must meet the necessary qualifications. Please talk directly to a Tricare representative to find out does Tricare cover bariatric surgery.

If you are covered, you must meet the following criteria:

- You must be 18 years of age or older.

- You must have a BMI of greater than 40.

- You must have a BMI of 35-39.9, and at least one of these diseases: diabetes, severe sleep apnea, hypertension, or cardiovascular issues.

Humana weight loss surgery coverage

If you have a Humana insurance policy, you might be wondering does Humana cover bariatric surgery? Let’s see.

Does Humana cover weight loss surgery?

Yes, Humana covers weight loss surgery unless you have chosen a plan that specifically excludes bariatric procedures.

Assuming you are covered, you have to meet the following criteria to qualify for Humana weight loss surgery:

- You must be 18 years of age or older.

- You must have a BMI of 40 or higher.

- You must have a BMI of 35-39, and at least one obesity-related illness including joint disease, diabetes, and hypertension.

- You must have tried a medically-supervised weight loss program for at least 6 months.

- You must have a signed letter from your primary doctor recommending mandatory bariatric surgery.

- You must be able pass a psychological evaluation that shows you can adopt a healthier lifestyle.

Does Humana cover gastric sleeve?

Yes, Humana generally covers gastric sleeve surgery but it’s best to call them directly to know does Humana cover gastric sleeve in your case.

AmeriGroup weight loss surgery

Some insurance policies offered by AmeriGroup cover bariatric procedures but we suggest talking to your AmeriGroup insurance agent directly to get a clear answer.

Does AmeriGroup cover weight loss surgery?

The bottom line is, yes, AmeriGroup does cover weight loss surgery if you have chosen the right insurance plan.

AmeriGroup bariatric surgery requirements

If you want to know how do I get approved for weight loss surgery through AmeriGroup, you must be able to meet the following criteria:

- You must be 18 years of age or older.

- You must have a BMI of 40 or higher.

- You must have a BMI of 35-39, and at least one obesity-related illness, including diabetes, hypertension, and sleep apnea.

- You must have proof that you participated in a weight loss program for at least 6 months in the last 2 years.

- You must have a written letter from your primary doctor recommending the weight loss surgery.

- You must a complete psychological evaluation that shows you are capable of modifying your behavior (diet and exercise) for lasting weight loss.

Related: Safe weight loss surgery in Mexico

HealthFirst weight loss surgery

Does health first insurance cover weight loss surgery? Let’s see.

Does HealthFirst insurance cover weight loss surgery?

Yes, some HealthFirst insurance policies provide coverage for weight loss surgeries. To know the answer to does HealthFirst cover bariatric surgery in your case, please contact HealthFirst directly.

HealthFirst requirements for gastric sleeve

Once you have made sure that you are covered, you will need to meet the following HealthFirst requirements for gastric sleeve or any other bariatric surgery:

- You must be 18 years of age or older.

- Your BMI must be 40 or higher.

- Your BMI must be 30-39, and you must also suffer from an obesity-related illness including severe sleep apnea, diabetes, or a cardiovascular disease.

- You must have no untreated metabolic condition that may be causing your obesity.

- You must have been overweight for 2-5 years.

- You must show proof that you’ve tried losing weight through non-surgical methods.

- You must be able to pass a psychological evaluation showing that you are capable of making long-term changes to your diet and lifestyle.

Reasons to be denied weight loss surgery

Although weight loss surgery is a highly safe procedure with exceptionally good success rates, a conscientious bariatric surgeon will only accept you as a candidate if they believe that the benefits significantly outweigh the risks. The surgeon’s foremost priority will be your safety, and you could be denied this procedure if the surgeon is convinced that you are not eligible for it. Here’s why some patients may fail to qualify for this surgery:

- Your BMI is low enough to be corrected with diet and exercise.

- You are under 18 years of age and your physiology is still developing.

- You have been diagnosed with a certain health condition that could pose threat to your safety during or after the surgery.

- You have been a regular smoker and are unwilling or unable to quit the habit for at least a few weeks before and after the surgery.

- You are taking blood thinners, NSAIDs, or other medications that increase your risk of surgery, and your physician cannot take you off them temporarily.

- You are not willing to commit to a pre- and post-operative weight loss surgery diet plan as recommended by your surgeon.

Steps to getting approved for gastric sleeve

Steps to getting approved for gastric sleeve surgery are important to know as you learn about the process. Your surgeon will evaluate your medical history and current physical state to determine eligibility.

- Several factors will be used for your approval, including your commitment to following instructions.

Confirm your BMI. Some patients may fear their BMI is not high enough for surgery. Those with a lower BMI can still be cleared on a case-by-case basis. - Contact your insurance to ask about additional information. Many times they require a psychological evaluation. Even if you may have medical or financial barriers to surgery, a surgeon may work with you to determine the most effective, safest way for you to have a gastric sleeve using a more personalized approach.

- Experienced medical tourism representatives can arrange a free consultation for you with a weight loss surgeon. You’ll experience a comprehensive program that can provide you with long-lasting results. However, if gastric sleeve was determined not right for you, other surgery options may still be available, such as a Gastric Bypass or a Gastric Lap Band surgery.

When you’re in need of surgery and others say “No!”, remember Jet Medical Tourism® for all your bariatric needs!

Jet Medical Tourism® an Help You Get Approved for Bariatric Surgery in Mexico!

The fact that only a handful of American insurance providers cover weight loss surgeries is bad enough, but if you are lucky enough to have chosen a plan with bariatric coverage, you must then prove that you are “worthy” enough to be saved. That’s the unfortunate reality many overweight Americans are living in.

Thankfully, there are other alternatives to the complicated American insurance system: get weight loss surgery in Mexico through Jet Medical Tourism®.

If you are considering bariatric surgery but find yourself unable to do so because your insurance provider is denying you coverage, call us today. Not only will you benefit from substantially reduced costs, you’ll also benefit with high-quality care similar in the US.

When insurance refuses to cover your weight loss surgery, Jet Medical Tourism® is your best bet towards an effective and affordable solution. With us, you won’t have to undergo lengthy processes to be able to receive the best medical care that you deserve. Our weight loss surgery approval and financing process is super quick:

- Get evaluated by one of our board-certified bariatric surgeons to ensure you are healthy enough for the surgery.

- Choose a weight loss surgery that best fits your requirement and medical needs.

- Choose a very affordable payment plan that allows you to pay for the surgery in small monthly installments.

- Go ahead with your surgery!

That’s it. The entire process takes less than a week and then you are free to enjoy the highly-noticeable results of your weight loss surgery. Contact us to know more about how to get weight loss surgery approved by insurance.

Jet Medical Tourism® offers safe and affordable weight loss surgery with lasting results.